Global-View

According to Business.com, e-commerce now accounts for more than three-quarters of all retail growth..Oberlo.com estimates global e-commerce sales at about $4.891 trillion in 2021 – an increase of 14.3% over 2020. This is significant, given that 2020 had seen a world in the throes of Covid-19, where e-commerce was the only game in town.

In other words, with year-over-year double-digit growth with no end in sight, e-commerce is the new marketplace.

As e-commerce opportunities expanded in the last decade, so did the challenges for individual entrepreneurs, startups, and businesses of all sizes – namely, the emergence of the “Gig” service economy and increasingly diverse transnational legal and regulatory environments.

As governments rush to tax and ensure competition, fair labor practices, and product safety, among a myriad of challenges, legal sanctions for compliance failures may not only incur fines and penalties but might put many small sellers out of business (see Amazon fines in Spain below).

Not only are new e-commerce markets emerging at a rapid pace, but established markets are also reaching new levels. With growth comes regulations and compliance requirements.

In the European Union, the digitalization and Gig economy that has helped to power e-commerce brings new forms of work and new risks for employees, which regulators are rushing to address.

Employers and e-commerce sellers now need to adapt to the constantly changing economic and regulatory environment that aims to provide appropriate levels of protection for workers as labor market mobility increases.

Legal infractions come in many forms, each presenting a different challenge for small businesses. As such, it is vital for e-commerce sellers to stay ahead of the game when it comes to individual legal responsibilities.

Luckily, a multitude of SaaS and IoT-based solutions have also emerged to satisfy much of the marketplace’s needs. Using in-country solution providers is the safest approach to mitigating risks and ensuring compliance.

It’s important to keep in mind that at heart, the regulatory intent is local economic development with regulatory frameworks as job-creation and social protection mechanisms.

Lorem available market standard dummy text available market industry Lorem Ipsum simply dummy text of free available market.There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or

Asia-Pacific

Asia-Pacific region makes up 62.6% of global e-commerce. This high concentration is both an opportunity for sellers into that market and a reflection of the low penetration and potential growth in other regions, particularly in the European Union.

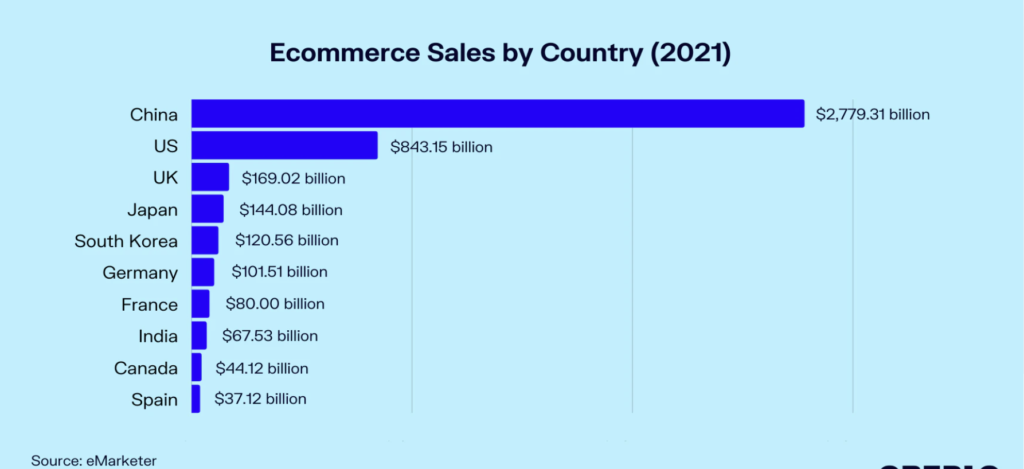

According to eMarketer, China, the US, the UK, Japan, and South Korea top the list. In European Union, Germany and are the leaders, with Spain at little under half the business done in France in 2021.

China

China is now the world’s retail behemoth, with an estimated $2.78 trillion in annual online retail sales, of which 52% is e-commerce – making it the biggest e-commerce market in the world. With an annual growth rate of 21%, China is also one of the fastest-growing e-commerce markets.

The Alibaba group and its subsidiaries – Taobao, Alibaba.com, and Tmall dominate the Chinese market.

While much is written about China’s global e-commerce dominance and growth, China’s rapid adoption of e-commerce is connected to a slew of cultural and structurally centralized automation mechanisms that easily identify customers and automate payments – aspects that are unacceptable in the west.

So in a sense, China’s dominance is incomparable and not indicative of growth in the west. Of significance, though, is e-commerce’s high level of penetration and growth, which means that Chinese sellers will soon have to look externally for growth.

Japan & South Korea

Japan and South Korea are the next biggest online retail markets in the world, with estimated annual online retail sales of $144 billion and $120 billion, respectively, of which e-commerce is 3% and 2.5%, respectively.

Rakuten, Japan’s leading e-commerce platform, has extended its global footprint outside Japan by acquiring other e-commerce platforms like the U.K.’s Play.com. Gmarket and Coupang are among the dominant players in South Korea.

However, the important thing to note about Japan and South Korea is that both are leaders in m-commerce (mobile commerce), which is the future of e-commerce as we move to 5G and beyond.

United States

The United States, where giants like Amazon, Walmart, and eBay pioneered e-commerce, is now the second-largest e-commerce market in the world, with an estimated $843 billion in online retail sales, of which e-commerce is 19%.

Amazon, along with Walmart and eBay, still tops the list, but others like Apple, Etsy, Shopify, and many others are also dominant players.

United Kingdom

Driven by Amazon U.K., eBay U.K., Asos, and others like Curry PC World, Gumtree, Argos, Tesco, John Lewis, and even Marks & Spencer, the UK is the largest online retail market in Europe (though outside the European Union) with an estimated $169 billion in annual online sales, of which 4.8% is e-commerce.

Germany

Powered by Amazon Germany, eBay Germany, Otto, Idealo, MediaMarkt, Lidl, Zalando, and others, Europe’s and the European Union’s largest economy, Germany, is also the Europe Union’s largest online retail and e-commerce market with an estimated annual online sales of $101.5 billion, of which, 2.1% is e-commerce.

Amazon, eBay, and local online retailer Otto are dominant e-commerce players in the country.

France

France is second to Germany, with an estimated annual online sales of $80 billion, of which e-commerce is about 1.6%. Top players include Veepee, Cdiscount, Auchan, Fnac, and Apple.

However, Amazon France dominates the French market in a league of its own. Of more than 120,000 active e-commerce websites in France, Amazon France enjoys over 15 million unique visitors per month – more than the combined amount for the next five top players combined.

Spain

Spain has an estimated annual online sales of $37 billion, of which 0.72% was e-Commerce in 2021. Amazon, El Corte Ingles, and PcComponentes dominate the e-commerce market in Spain, accounting for 30% of all online revenue in Spain.

Oberlo recently published Marketer data gives a picture of the world’s biggest e-commerce markets (in terms of sales) by country and e-commerce trends.

Global Trends

The Internet of Things (IoT) enables companies to collect real-time data and provide real-time customer responses. This will become a driver of e-commerce growth in the future.

The bifurcation of traditional e-commerce channels and the increasing availability of multiple cross-channel means of sales are also driving the growth of e-commerce growth.

An erosion in exclusive selling through individual websites or dedicated branded platforms enables sellers to reach clients via many channels, such as Amazon and eBay, as well as dominant in-country players with an established client base.

Checkout simplicity and flexible payment processing solutions like Stripe are also major drivers of e-commerce expansion. The m-commerce (mobile) that powers Japan’s and South Korea’s e-commerce market is the future of global e-commerce, and as global platforms adopt m-commerce, growth will continue to be exponential.

Challenges

The emerging legal frameworks will pose the primary challenge for e-commerce start-ups, individual entrepreneurs, and small businesses. It behooves entrepreneurs, start-ups, and small businesses to engage local in-country solution providers to control costs, mitigate risks, and ensure compliance.

In a European Union that is very keen on encouraging competition by supporting small entrants to the marketplace and taking a regulatory hammer to the giants, great opportunities exist for startups, individual entrepreneurs, and small businesses with a strong focus on compliance.

Big companies and e-commerce giants like Amazon and others have the resources and infrastructure to keep abreast and comply with local laws. But even they routinely run afoul of national laws and incur significant fines from time.

The following are just two examples of amazon’s recent woes in Europe.

Case: Illegal Background Checks

On February 11, 2022, the Spanish data protection authority, AEPD (Agencia Española de Protección de Datos), fined Amazon Road Transport Spain S.L. €2,000,000 for a violation of Articles 6(1) and 10 of the General Data Protection Regulation (Regulation (EU) 2016/679) (‘GDPR’), and Article 10 of the Organic Law 3/2018, of 5 December 2018, on the Protection of Personal Data and Guarantee of Digital Rights, LOPDGDD (Ley Orgánica 3/2018 de Protección de Datos Personales y garantía de los derechos digitales).

Amazon Road Transport requested applicants to consent to background checks to verify clean criminal records as part of its hiring process. This would seem a reasonable security measure for its customers and a routine measure in countries like the United States and Britain.

But a General Union of Workers representative flagged these employment practices for self-employed contractors and filed a claim with the AEPD because the information that Amazon Road Transport gathered could be transferred to Amazon group companies and their suppliers outside the European Economic Area.

At the heart of the case was the following issue:

Certificates showing “clean” criminal records amounted to personal data relating to criminal convictions and offenses, which is regulated by Article 10 of the General Data Protection Regulation (EU) 2016/679 (GDPR). So, collecting clean criminal records allowed Amazon companies to compile data without complying with GDPR safeguards.

Private entities may process this type of data only when the European Union or Member State law authorizes such processing and provides appropriate safeguards for data subjects’ rights and freedoms (Article 10 of GDPR – processing personal data relating to criminal offenses).

Spain has no such law (exemptions) that would allow a company like Amazon Road Transport to process criminal-related data in the process of contracting freelance drivers. Where transportation laws exist (for example, in cases of vehicles 3.5 tons or higher), they require drivers to meet trustworthiness thresholds that prohibit criminal convictions.

But only public licensing authorities can make those assessments and determinations based on information available in authorized national or European Union databases – like the Register of Transport Undertakings and Activities and the European Register of Road.

But even these public authorities are prohibited from requesting proof of the absence of criminal records from individuals. So Amazon Road Transport had clearly violated the laws. It had no basis for legally collecting and using personal data on criminal convictions and offenses in its hiring.

Amazon’s defense was that because these certificates are of negative criminal record (absence) and do not contain any data relating to the commission of crimes, the collection of the data is not processed, and the collection of the certificates does not fall under Article 10 of the GDPR and LOPDGDD.

The AEPD rejected Amazon Road Transport’s first interpretation of Article 10 of the GDPR as well as its second, stating that Article 10 of the LOPDGDD relates to criminal convictions and offenses, not necessarily to criminal records or the absence thereof, as Amazon claimed.

The AEPD also made clear in its decision that the public authorities are the ones who assess driver requirements to perform their activity during its licensing process. While private entities like Amazon Road Transport are limited to checking whether the relevant driver has the appropriate authorization from the state, they are prohibited from assuming the role of a supra-state.

Case:

In yet another Amazon case in Spain, after a multi-year investigation by regional labor authorities, in August 2022, Catalonia fined Amazon €3.2 million for breaching labor laws in its subcontracting practices in Spain. This was the second fine in as many years. In 2020, they issued Amazon over €800,000 in penalties relating to the same issue.

Cumulatively, the Catalan Generalitat (regional government) also issued some €2.6 million to seventeen local Amazon delivery subcontractors for their delivery services and provision of temporary staffing to Amazon.

The Catalan Labour Inspectorate confirmed to the press that was proposing a total fine of €5.8M to Amazon for subcontracting workers, in violation of the Statute of Workers Rights.”

As digitization and e-commerce expand with the proliferation of the Gig economy, so will the promulgation of legislation in Europe. For the entrepreneur, startup, or small business, getting the help of in-country specialists and solution providers is the best way to ensure compliance and mitigate risks.

2 Responses

Pretty! This has been a really wonderful post. Many thanks for providing these details.

Glad you found it helpful.